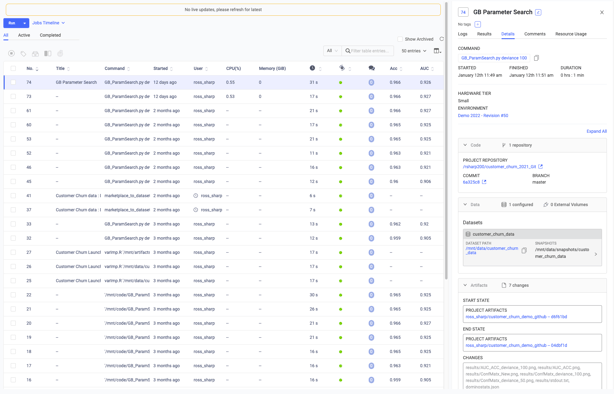

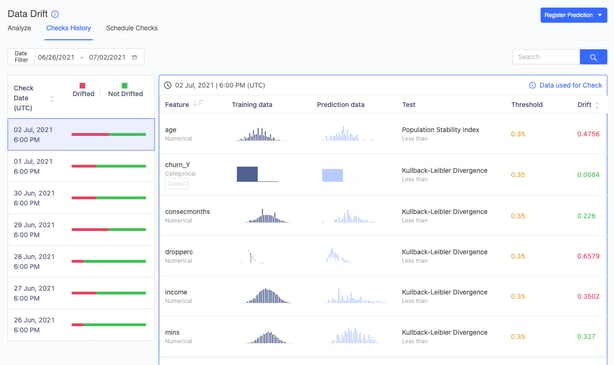

Streamlined access to data

Easy access to data without compromising security and governance

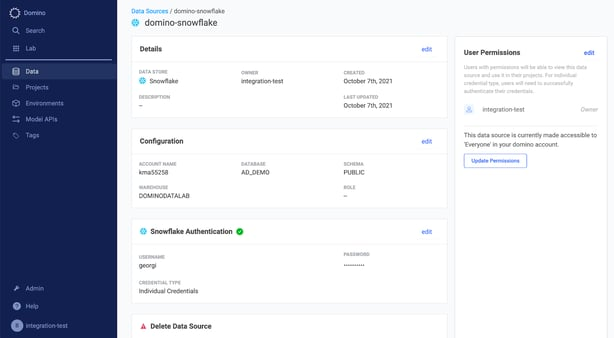

With Domino, you and your team can easily work with and share data while complying with IT protocols, data security, and governance policies.

Benefits:

- Centrally establish connections to data wherever it lives.

- Share data across teams without making copies.

- Provide data context and metadata in a unified manner within and across departments or LOBs.

- Maintain strict governance and control over sensitive data.

- Effectively manage data with integrated version control.

- Integrate with established company SSO and LDAP solutions.