Why Models Will Run the World

Matthew Granade2018-09-27 | 14 min read

Domino is built on a couple of core beliefs:

- Models will be at the heart of the most successful businesses in the world over the next couple of decades, and

- Companies need new organizational capabilities to manage them (just like they built to manage capital, people, and technology).

Earlier this year, Nick Elprin, Domino’s co-founder and CEO, laid out his vision for what these organizational capabilities will need to look like, describing a new discipline called model management. Model management describes a new category of technologies and processes that help organizations consistently and safely develop, validate, deliver, and monitor models to create a competitive advantage.

More recently, I co-authored an article in the Wall Street Journal titled “Why Models Will Run the World.” The piece covers the rise, importance, and implications of model-driven businesses.

Domino would like to extend a special thanks to the authors for their permission to repost the full piece below.

Marc Andreessen’s essay “Why Software is Eating the World” appeared in this newspaper Aug. 20, 2011. Mr. Andreessen’s analysis was prescient. The companies he identified— Netflix, Amazon, Spotify—did eat their industries. Newer software companies—Didi, Airbnb, Stripe—are also at the table, digging in.

Today most industry-leading companies are software companies, and not all started out as such. Aptiv and Domino’s Pizza, for instance, are longstanding leaders in their sectors that have adopted software to maintain or extend their competitive dominance.

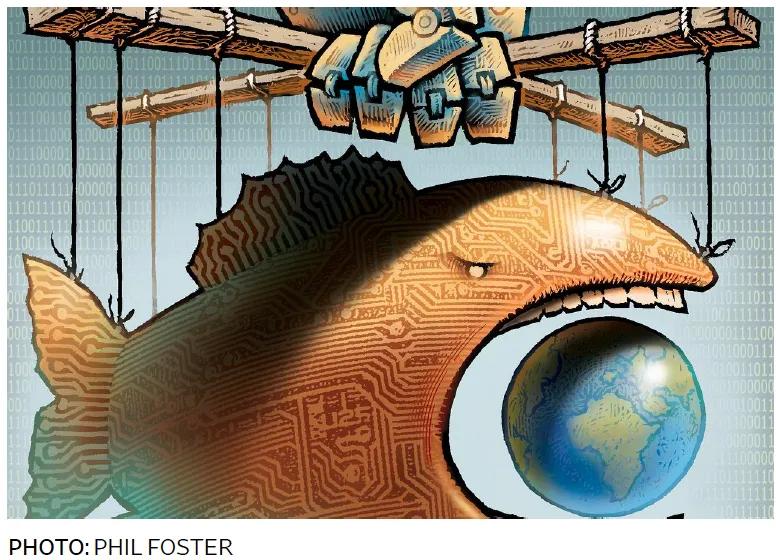

Investors in innovative companies are now asking what comes next. We believe a new, more powerful, business model has evolved from its software predecessor. These companies structure their business processes to put continuously learning models, built on “closed loop” data, at the center of what they do. When built right, they create a reinforcing cycle: Their products get better, allowing them to collect more data, which allows them to build better models, making their products better, and onward. These are model-driven businesses. They are being created inside incumbents and startups across a range of industries.

If software ate the world, models will run it.

There is no shortage of hype about artificial intelligence and big data, but models are the source of the real power behind these tools. A model is a decision framework in which the logic is derived by algorithm from data, rather than explicitly programmed by a developer or implicitly conveyed via a person’s intuition. The output is a prediction on which a decision can be made. Once created, a model can learn from its successes and failures with speed and sophistication that humans usually cannot match.

A model-driven business, then, uses models to power the key decisions in its business process, creating revenue streams or cost efficiencies. Building this system requires a mechanism (often software-based) to collect data, processes to create models from the data, the models themselves, and a mechanism (also often software based) to deliver or act on the suggestions from those models.

A model-driven business is something beyond a data-driven business. A data-driven business collects and analyzes data to help humans make better business decisions. A model-driven business creates a system built around continuously improving models that define the business. In a data-driven business, the data helps the business; in a model-driven business, the models are the business.

Tencent, the Chinese social-media giant and maker of WeChat , is one of our favorite examples of this new business model. A Tencent executive told us last fall: “We are the only company that has customer data across social media, payments, gaming, messaging, media, and music, and we have this information on [several hundred] million people. Our strategy is to put this data in the hands of several thousand data scientists, who can use it to make our products better and to better target advertising on our platform.” That unique data set powers a model factory that constantly improves user experience and increases profitability—attracting more users, further improving the models and profitability. That’s a model-driven business.

Netflix beat Blockbuster with software; it is winning against the cable companies and content providers with its models. Its recommendation model is famous and estimated to be worth more than $1 billion a year in revenue, driving 80% of content consumption. Any time a customer accepts or rejects a recommendation, Netflix’s algorithm improves. The company’s current battle is against Hulu, Apple and Disney. Who will win? Whoever has the best capacity to build and integrate models into the business. Who can collect the best data about customers, who can recruit the best data scientists, and who can build the best prediction engine?

Amazon used software to separate itself from physical competitors like Borders and Toys “R” Us, but its models helped it pull away from other e-commerce companies like Overstock.com. By 2013 an estimated 35% of revenue came from Amazon’s product recommendations. Those models have never stopped improving. Jeff Bezos’ 2016 shareholder letter described the myriad ways Amazon uses machine-learning models, from highly visible initiatives like Prime Air Drones to beneath-the-surface applications such as product placement, fraud detection and translation. The recent Whole Foods and PillPack acquisitions will bring Amazon’s model-driven power to new industries.

A skeptic might argue that these examples are merely the winning companies of the past decade continuing to win. But the transformation we are describing is taking shape across a range of industries, including many usually described as traditional. Here are three examples:

- Agriculture. Mankind’s first industry increasingly uses models to improve crop yields. The Climate Corp.’s (TCC) early focus was on using models to provide crop insurance to farmers. In 2013 Bayer bought TCC for $1.1 billion and expanded its focus—given Bayer’s deep integration into farms and its data assets—into model-driven farming. Looking to produce more-resilient crops, Bayer’s models predict optimal places for farmers to plant based on historical yields, weather data, tractors equipped with GPS and other sensors, and field data collected from satellite imagery, which estimates where rainfall will pool and subtle variations in soil chemistry.

- Logistics. The rapid growth of e-commerce has created a new challenge here. The typical fulfillment center has human pickers walking 15 miles a day through warehouses to assemble orders. To solve this problem, inVia Robotics builds robots that can autonomously navigate a warehouse and pull totes from shelves to deliver them to a stationary human picker. The approach is model-driven; inVia uses models that consider item popularity and probability of association (putting sunglasses near sunscreen, for example) to adjust warehouse layout automatically and minimize the miles robots must travel. Every order provides feedback to a universe of prior predictions and improves productivity across the system.

- Services. In this labor-intensive sector, it always has proved difficult to increase productivity, but the model-driven approach may change that. Take translation services. Companies spend more than $20 billion a year translating everything from catalogs to their terms of services into hundreds of languages. While Google Translate works well for the everyday consumer, businesses typically require the more sophisticated skills of a human translator. Lilt, a San Francisco-based startup, is building software that aims to make that translator five times as productive by inserting a model in the middle of the process. Instead of working from only the original text, translators using Lilt’s software are presented with a set of suggestions from the model, and they refine those as needed. The model is always learning from the changes the translator makes, simultaneously making all the other translators more productive in future projects.

The implications of the rise of model-driven businesses are vast. From a business perspective, we see five key points:

First, businesses will increasingly be valued based on the completeness, not just the quantity, of data they create. Why are Tencent and Amazon able to succeed? Not only because of the breadth of their data—knowledge of who their customers are; where they went before, after and during their visit; everything they saw along the way—but also that the data is “closed loop.” For each recommendation a model makes, the user’s response—for instance, buy or don’t buy—is captured and used to improve the model. With closed-loop data, the company knows the inputs and the outputs, the prediction and the eventual outcome. In contrast, businesses with less complete data sets are left to rely on human intuition to develop hypotheses and interpret results, limiting the pace and scope at which they can advance. Given the foundational role of data in building model-driven businesses, those that can create closed-loop data will be meaningfully more valuable.

Second, the goal is a flywheel, or virtuous circle. Tencent, Amazon and Netflix all demonstrate this characteristic: Models improve products, products get used more, this new data improves the product even more. This creates a near-frictionless process of continuous improvement, fueling itself, rather than being driven by human judgments and advancements. The truly terrifying realization for many executives—as Mr. Bezos described in his shareholder letter—is that many of the model-driven improvements happen beneath the surface in more-efficient operations and improved decision-making.

Third, incumbents will be more potent competitors in this battle relative to their role in the battles of the software era. They have a meaningful advantage this time around, because they often have troves of data and startups usually don’t. Incumbents will have opportunities to create models with their own data as well as to sell their data to others. Startups will have to be more clever in how they gain access to data and may, in fact, have to acquire incumbents.

Fourth, just as companies have built deep organizational capabilities to manage technology, people, and capital, the same will now happen for models. As the software era took hold, companies everywhere hired chief technology officers, assembled teams of engineers, and designed processes like Agile to deliver software in a systematic, industrialized fashion to their businesses. Companies wanting to become more model-driven will need to create a new discipline of model management—the people, processes and technologies required to develop, validate, deliver and monitor models that create that critical competitive advantage.

Fifth, companies will face new ethical and compliance challenges. As data has become more comprehensive and important, consumers’ concern over its use and abuse has similarly increased. Facebook ’s market capitalization dropped $120 billion in late July due in part to investors’ growing concerns about the company’s data assets in the face of increasing regulation and backlash from the Cambridge Analytica scandal.

Examples like this will multiply. Models themselves will raise more complicated issues. To what standards of accuracy must we hold a model when it is making a high-impact decision, such as diagnosing a disease, providing a loan, or admitting a student to college? Issues of fairness, accountability and transparency are business questions as much as philosophical ones, because companies that get them wrong will lose customers’ trust and incur meaningful liabilities.

Software continues to eat the world, but yesterday’s advantage is today’s table stakes. In the hunt for competitive advantage, model-driven companies will accelerate away from the pack now that software has become ubiquitous. As Mr. Andreessen predicted, software was a great place to make money over the past seven years. In the next seven, our bet is on model-driven businesses.

Mr. Cohen is founder, chairman, and CEO of Point72 LP, which includes Point72 Asset Management and Point72 Ventures. Mr. Granade is managing partner of Point72 Ventures and chief market intelligence officer at Point72 Asset Management. In 2013, he co-founded Domino Data Lab. Point72 Asset Management makes long and short investments in all of the public companies named in this article, and the authors have direct ownership in inVia Robotics through Point72 Ventures.

Matthew is an experienced executive and business builder at the intersection of advanced analytics, data, finance, and technology. As a co-founder and member of the board, he brings to Domino decades of experience in management and market positioning to help the company unleash data science at the world’s most sophisticated companies. Matthew previously built Point72 Ventures and was Co-Head of Research at Bridgewater Associates.